Last week one of the medtech CEOs I work with recommended a book: “The Checklist Manifesto: How To Get Things Right” by Atul Gawande. I was intrigued by his 2 minute summary on a tube ride in London – depicting how you go about building safe skyscrapers and improving investor returns. It’s also relevant to building entrepreneurial companies.

While I have no intention of learning how to build skyscrapers, his mention of investors got my attention. So, this week I read the book. I was not disappointed.

Atul Gawande is a Boston-based general surgeon with a special interest in endocrine tumors. I’d come across him before from a New Yorker article, through another recommendation describing how to optimize supply chain, and using the Cheesecake Factory as a case study.

Much of what he writes about is by making observations from the world around him and then relating them back to his surgical practice. This makes his work doubly interesting, since as an ex-physician, it’s always fun to read about clinical practice relating to real life. But also, it’s interesting since he makes deep observations from disparate sources, leading to industry transferable insights (often the best kind, and described in Innovation: incremental vs. game-changing).

He’s also one of the few individuals I can think of who continues to practice in his chosen professional field, yet has a way of communicating novel ideas that are accessible to the broader world.

Simple, complicated and complex problems

In the book, Gawande talks about three kinds of problems in the world. These are simple, complicated and complex. He describes:

- Simple problems as being like baking a cake. You follow a recipe, and with a little practice you can get good, reproducible results.

- Complicated problems are like sending a rocket to the moon. They may be broken down into a series of simple steps, but there is still a huge amount of intricacy, interaction required between different team-members, and frequent unanticipated difficulties. Timing and co-ordination are crucial.

- Complex problems are like raising a child (my wife and I are early on muddling through two of these at present). Experience may be helpful, but no two children are alike, and the outcomes are highly uncertain.

In many areas of professional discipline, he refers to the “Master Builders” – someone who is so practiced in his art, so experienced and with knowledge broad and deep enough that he can deal with almost any situation in their field – be it surgery, building skyscrapers, flying jumbo jets or investing.

Yet, as we all know, the body of required knowledge has progressed so much that no one individual can possibly know it all. Hence the rise of the specialist and super-specialist. Though, to deliver effective results requires intricate interaction between such specialists. No mean feat.

This is where checklists come into their own. When there is so much to consider and remember, often the mundane or routine, in high pressure situations can be missed. Yet such routine activities can have an out-sized effect.

Gawande describes the work of a critical care specialist in John Hopkins, Peter Pronovost, trying a doctor checklist to control central line infections in ICU. In order to prevent central line infections, doctors are meant to follow 5 simple steps – 1. wash their hands with soap, 2. clean the patients skin with antiseptic, 3. cover the entire patient with sterile drapes, 4. wear a mask, hat, sterile hat and gloves, 5. put a sterile dressing over the insertion site once the line is in.

Over a follow-up period of just over 2 years, they found that the checklist led to a decline in 10 day line infection rates from 11% to zero. They had prevented 43 line infections, 8 deaths and saved over $2 million in costs. Other checklists were established for pain control and proper support for patients on ventilation. For pain control, the rate of patients experiencing untreated pain fell from 41% to 3%. For patients on ventilation, patients not receiving proper support fell from 70% to 4%, pneumonias fell by a quarter and there were 21 less deaths than the year before. Pretty stunning results by any measure.

Why did the checklists work? Gawande says:

“These checklists accomplished what checklists everywhere have done, Provonost observed. They helped with memory recall and clearly set out the minimum necessary steps in a process. He was surprised to discover how even experienced personnel failed to grasp the importance of certain precautions… Checklists, he found, established a higher standard of baseline performance.“

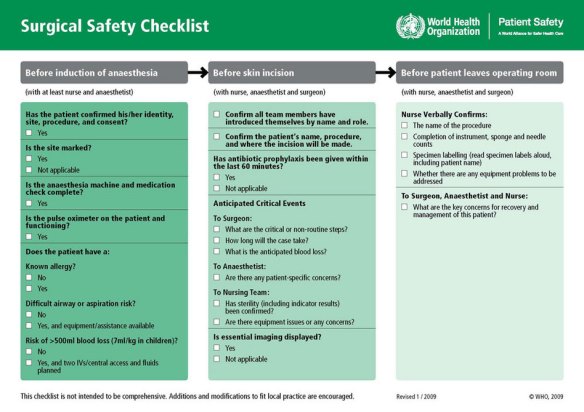

He also describes how working with the World Health Organization, and with doctors and other surgical staff from around the world, the team were able develop a Surgical Safety Checklist that vastly improved outcomes for surgery in general around the world, and for specific procedures. This was regardless of whether being practiced in high-end, high-cost surgical environments in the developed world, or in almost make-shift surgical environments, drastically understaffed in comparison, in developing countries.

Gawande goes into quite some detail looking at two other professional areas that actually have refined the process much more than in medicine. One is in building skyscrapers and the other in developing airline safety.

Without describing the advanced and early use of checklists in these areas (the book gives a chapter to each), the over-riding features of using checklists are that they:

- Enable experts in their chosen fields to work together in highly skilled, multi-disciplinary teams, often times without previous experience of the whole teams having worked together before

- Vastly improve performance and safety. According to a Ohio State University study quoted in the book, the US has 20 serious building failures a year – equivalent to an annual avoidable failure rate of 0.00002%. Checklists also enabled the saving of 155 lives in the “miracle of the Hudson” in January 2009, when Chelsey B. “Sully” Sullenberger III, and his team, landed and evacuated an Airbus A320 on the Hudson River, New York following multiple engine failures.

Checklists for rock-stars

Gawande also gives examples of successful use of check-lists by rock stars. In his book, “Crazy from the Heat”, David Lee Roth, lead singer of Van Halen describes how their productions were the first to be so large – with scope for many technical errors. Checklists ensured, for example, that girders could hold the weight of stage on the arena floor. Contracts were detailed, so to ensure all requirements were met, Roth introduced a test to demand no brown M&M’s in the backstage snack bowl. Anytime he found them, he knew there were shortcomings and everything had to be checked again.

Others included high-end restaurateurs consistently producing exquisite, boutique quality cuisine – to Walmart’s early help (a full day before the government responded) to victims stricken by Hurricane Katrina in New Orleans in 2005.

Investment checklists?

And there were examples from the investment world. These included three value based fund managers, including Mohnish Pabrai who manages some $500 million. His investment approach is outlined in his own book, “The Dhando Investor”. He describes a disciplined and thoughtful approach, using a helpful example from the Patels. The book cover quotes:

“The Patels, a small ethnic group from India, first began arriving in the United States in the 1970s as refugees with little education or capital. Today they own over $40 billion in motel assets in the United States, pay over $725 million a year in taxes, and employ nearly a million people. How did this small, impoverished group come out of nowhere and end up accumulating such vast resources?”

In essence the approach was simple, though required considerable discipline. The Patels bought motels where they could repay the purchase price within 3 years from cash-flow.

Pabrai adopts this idea to his own investing, where he looks for businesses valued considerably under their assets, and which throw off strong positive cash-flows. Though over 15 years of investing, his approach has refined. Some of this was influenced by studying his own mistakes and the processes and mistakes of others (including Warren Buffett, who seems to use a mental checklist).

He has now developed an investing checklist of seventy checks in all, protecting against the mistakes he had catalogued. The checklists enabled not only avoiding mistakes, but also processing potential investment opportunities at a much faster rate than possible without checklists.

When the markets crashed in late 2008, as others were panicking, Pabrai managed to assess over 100 companies in a single quarter, add ten to his portfolios, and was up over 160% on average over the next year (clearly this is not repeatable every year, but does show how powerful the checklists became when opportunity came a-knocking).

It also works for VCs. Particularly when figuring out if a certain CEO will be the right one to execute on a business plan. Geoff Smart, a PhD psychologist at Claremont Graduate University did a study of 51 VCs. He classified 6 ways that VCs use to assess CEO talent – including gut instinct, to interrogation to a handful using checklists.

His study showed that while good VCs were successful using a variety of approaches – experience has value – the “airline captains” category that used checklists outperformed by far. They had a median 80% return, with the others 35% or lower.

Actionable and effective

For checklists to be useful, practical and effective, Gawande found that they had to be short – ideally 5-9 points. They do not have to include everything to fulfill any given complex task. But they do need to include a basic things that make a difference. The purpose is not to replace the specialists’ expertise – but to buttress it in ties of stress, and as quoted above “establish a higher standard of baseline performance”

Looking for an edge, and ways to improve performance, I decided to develop my own investment checklist. Using screens and watchlists are already something I do – in a way they are the beginnings of a checklist. They help provide a set of rules to take out some of the emotion for investing.

Yet it’s still too easy to be seduced by uncovering what you think is a missed value opportunity. As Pabrai says, “you go into greed mode…you get seduced…you start cutting corners.” Another of the interviewed investors calls it “cocaine brain” – a term coined after neuroscientists found that the prospect of making money triggers the same primitive reward circuits as cocaine does.

So, as I built my first draft of an investing checklist, I realized how valuable it could be. As well as including the 4 criteria I use in my screens, I added some of the other features I also look at when assessing investment opportunities. My initial list of 9 for buying include: valuation, debt, profitability, growth, incentives, charts, headlines, diversification and expected return.

And as I listed them, I realized that despite knowing them, and over several years having developed my own approach (while standing on the shoulders of investment giants) I don’t use all of them every time. Hmm. I’m already thinking about developing other checklists to cover sub-topics (I’ve dealt with the line infections, now need to address specific scenarios).

It’s actually quite liberating. To become a good investor, I no longer have to worry about being a genius, or blessed with unusual insight or powers of prediction (I never was). I just have to develop, and follow, some well thought out checklists.

Entrepreneurial medtech companies

On another personal level, working with entrepreneurial medtech companies that are close to or at product commercialization stage, I’m also starting to appreciate the value of checklists. Historically, companies I’ve worked with have been at product development stage – since I’m not involved in any in depth way in clinical trials or safety testing, these are areas that I’m aware of but not detail focused.

My areas have been in strategy and corporate development – not areas I would have previously thought to breakdown with checklists. Another of our fallacies – the things we do all the time, we think we understand, have practiced and have developed inbuilt processes. As examples above show, there’s still considerable room for improvement. So, I’m thinking of how checklists could be used in financing or partnering processes.

And now, moving into commericialization with a couple of companies, the standard operating procedures (a form of checklists) become very important. It’s not just about supporting an innovative entrepreneur at the early, swashbuckling stages of a venture. Now it’s about turning them into real businesses, with products, customers, scalability and yes, you guessed it….checklists.

What will you checklist?

By Raman Minhas.

An edited version of this post appears at kaizen investor, particularly with a focus on applying checklists to value investing (including my own checklist).